Root, Inc. IPO

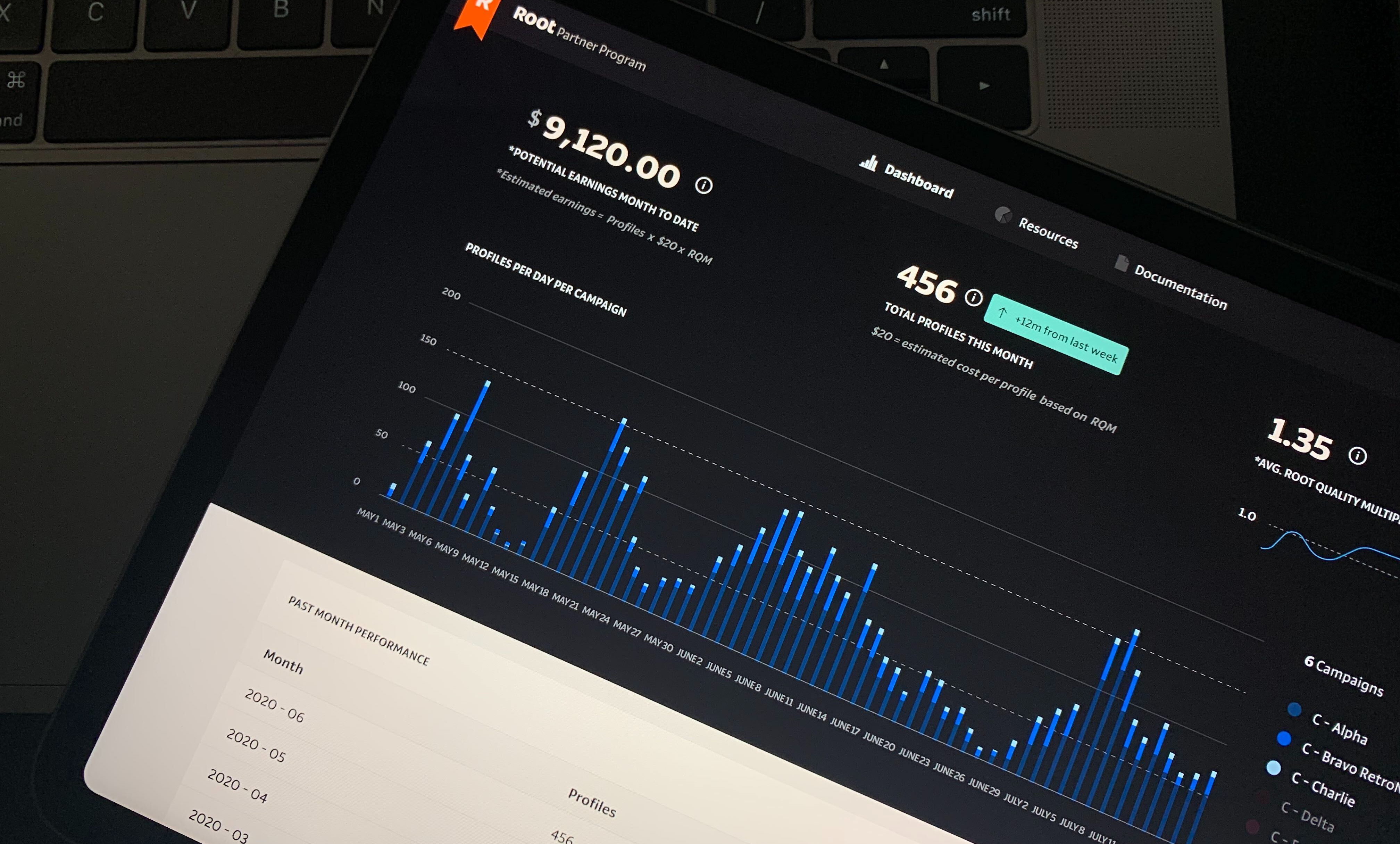

Introduced new revenue streams while directing Design for Root R&D

Root is a leading insurtech company that leverages data and technology to provide personalized insurance solutions.

Our journey to identify market opportunities was marked by extensive competitive analysis and a deep understanding of the ecosystem. Through this thorough examination, we recognized the strategic potential of introducing home insurance to Root's product line. This strategic decision was grounded in rigorous market research, user studies, and competitive analysis, which collectively underscored the pressing need for a home insurance product that effectively catered to market demands while aligning with the company's growth objectives.

Market research and analysis formed the cornerstone of our approach, guiding us to pinpoint areas of opportunity to introduce a home insurance product that resonated with users and effectively addressed market needs. This involved a meticulous analysis of other businesses in the space, allowing us to identify gaps and opportunities that would set Root's home insurance offering apart. Furthermore, collaborating with legal and finance teams was pivotal in developing robust underwriting and pricing models, essential for navigating the complexities of the insurance landscape.

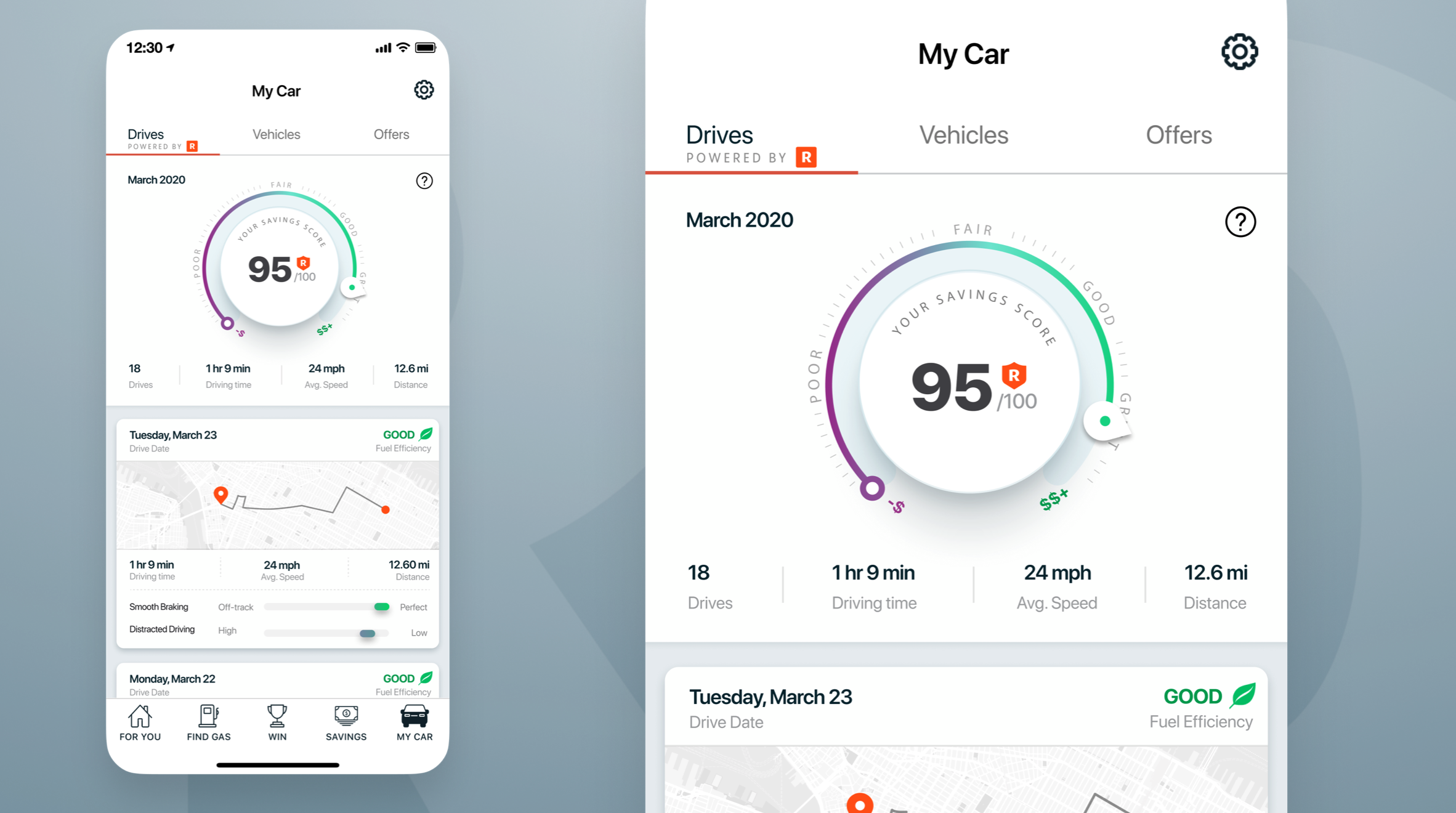

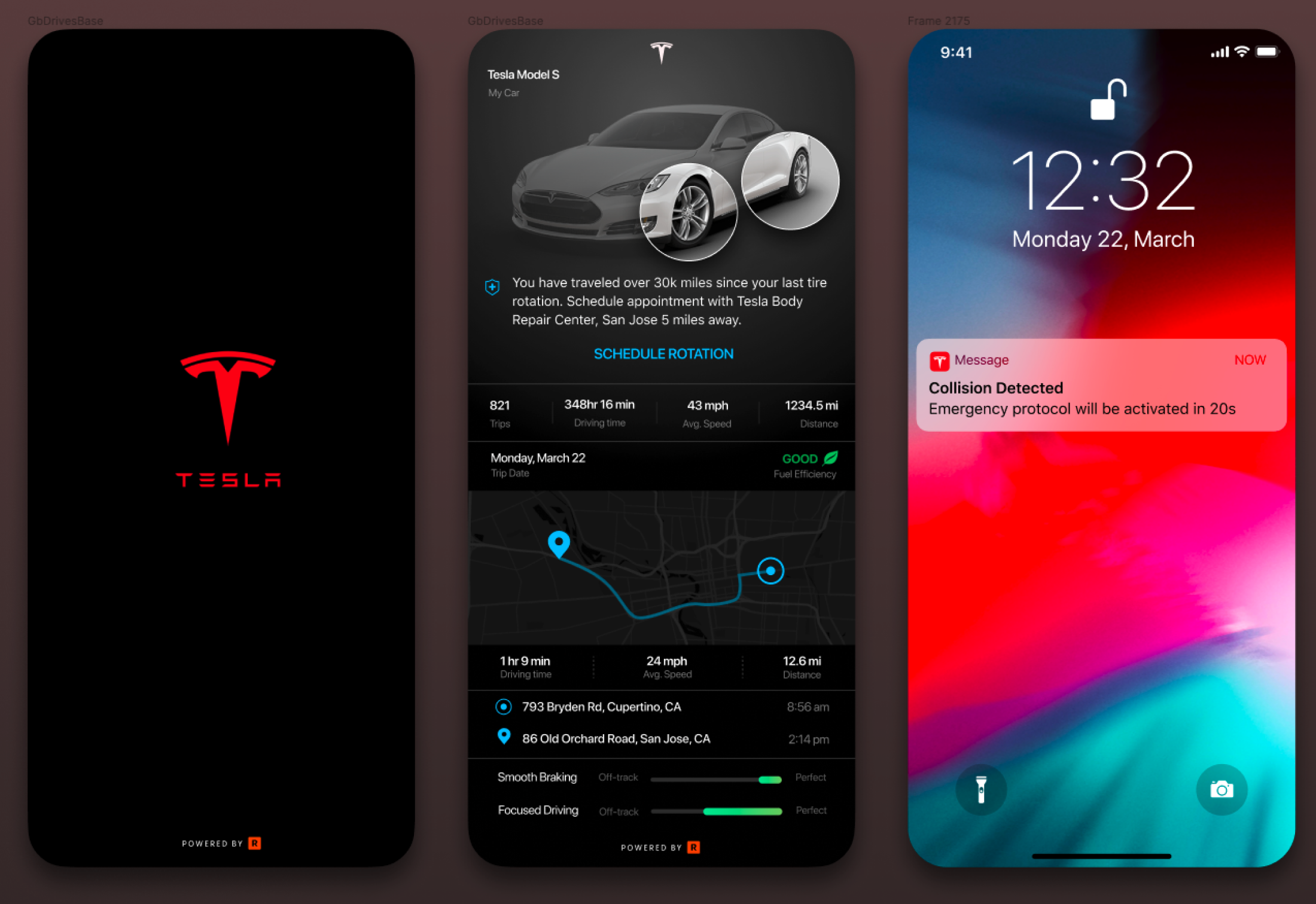

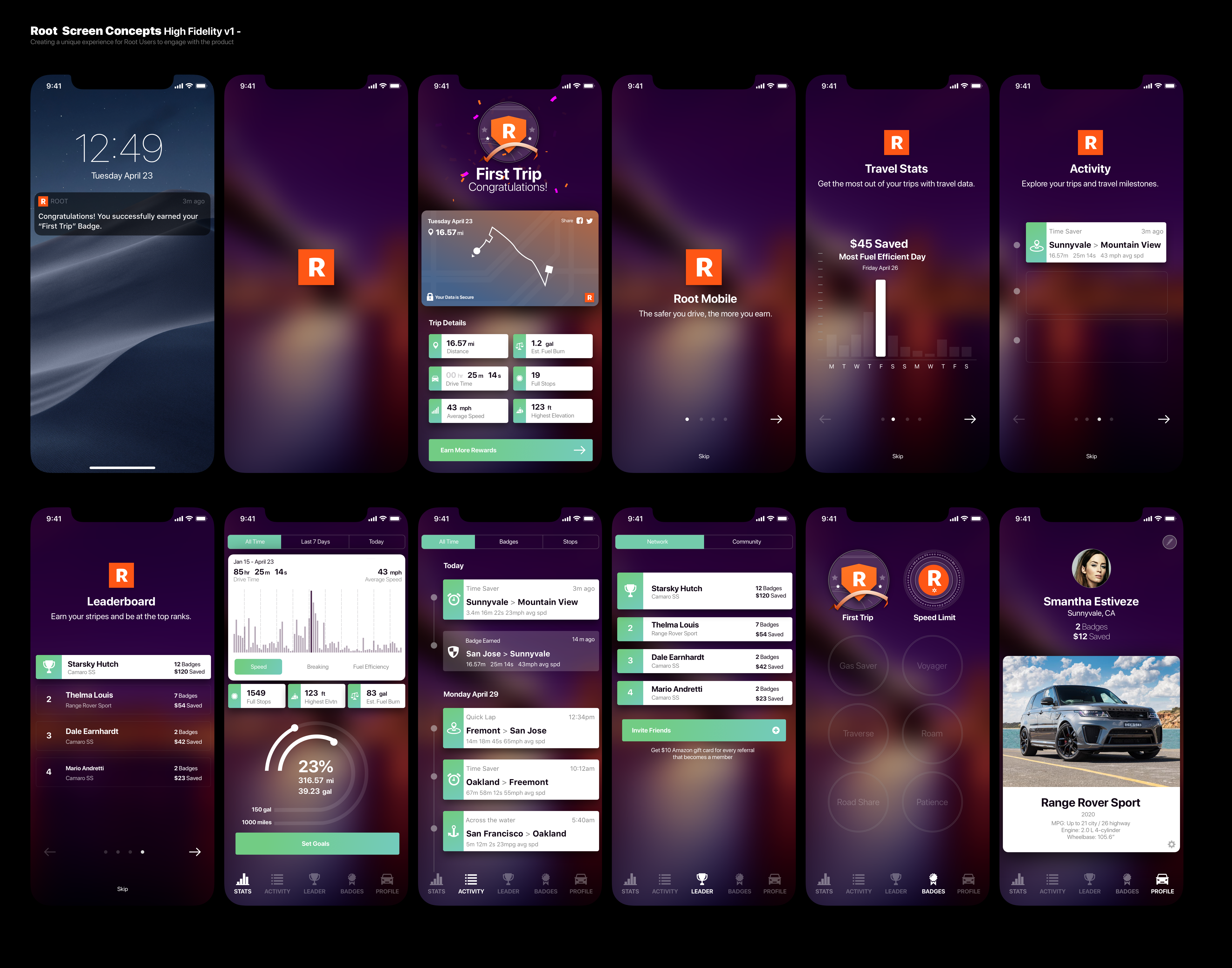

Our technology integration efforts were centered on leveraging telematic information and cutting-edge phone technologies to identify features and workflows that seamlessly integrated into our home insurance product line. This approach ensured a smooth and efficient user experience, particularly in terms of policy acquisition and management processes.

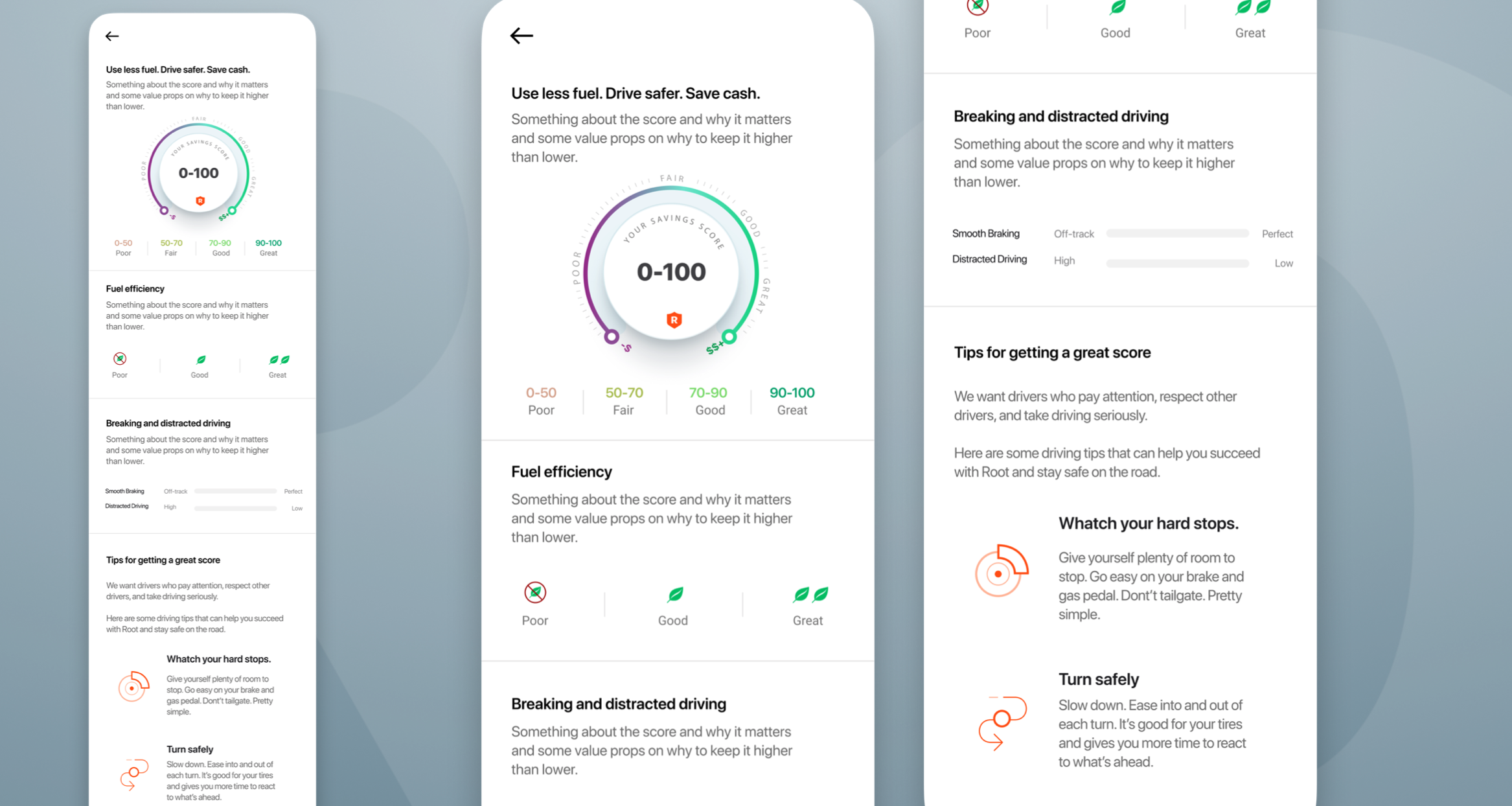

The design of user journeys was a collaborative effort that involved creating comprehensive journey maps, storyboards, workflows, and working diagrams. These tools were instrumental in aligning processes and defining the necessary steps for an optimal home insurance journey. By incorporating key product attributes such as trust, speed, technology, and thoroughness, we developed functional prototypes that were subjected to rigorous user studies with live participants. This iterative process helped validate the technology's viability and its potential to meet user expectations effectively.

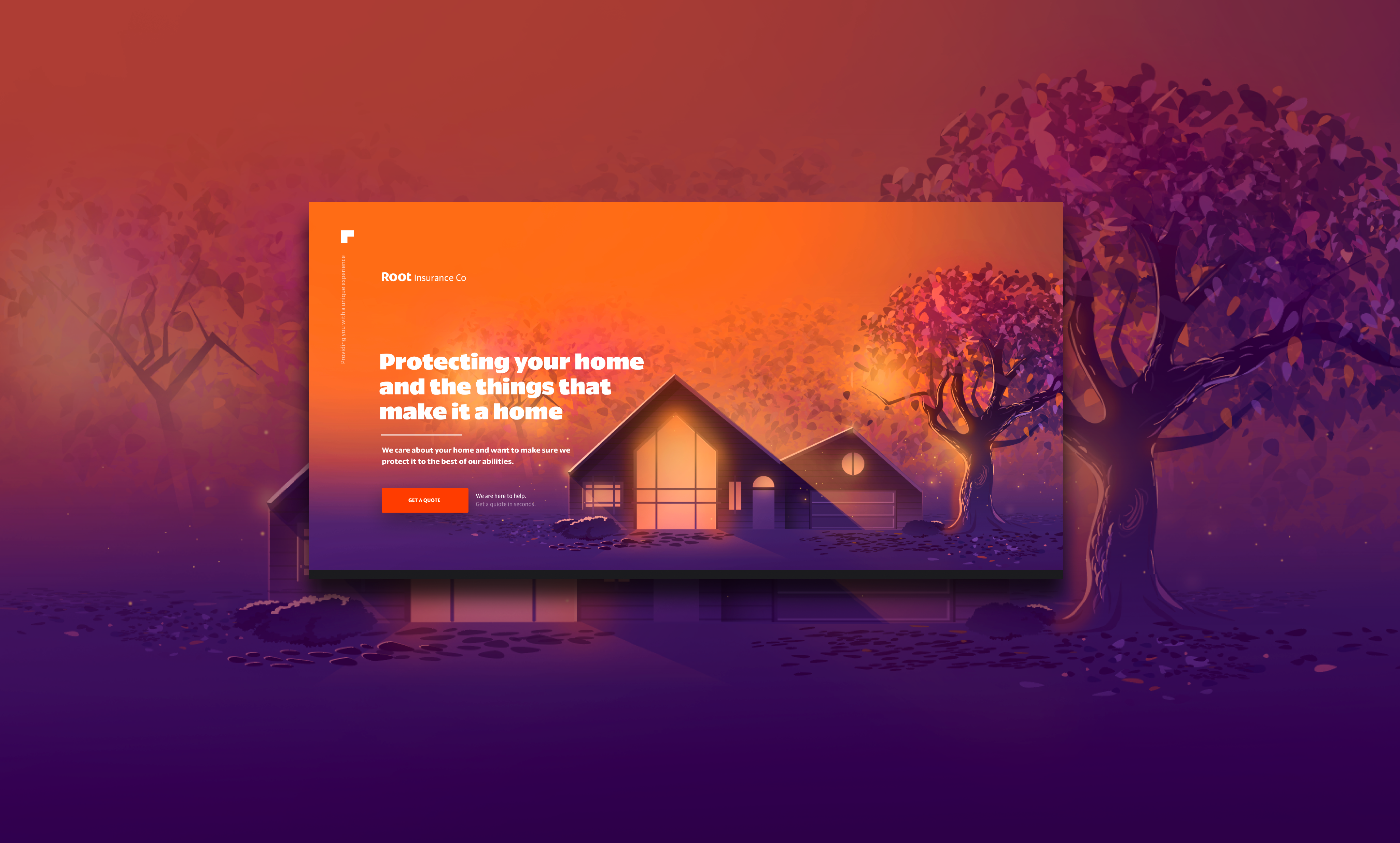

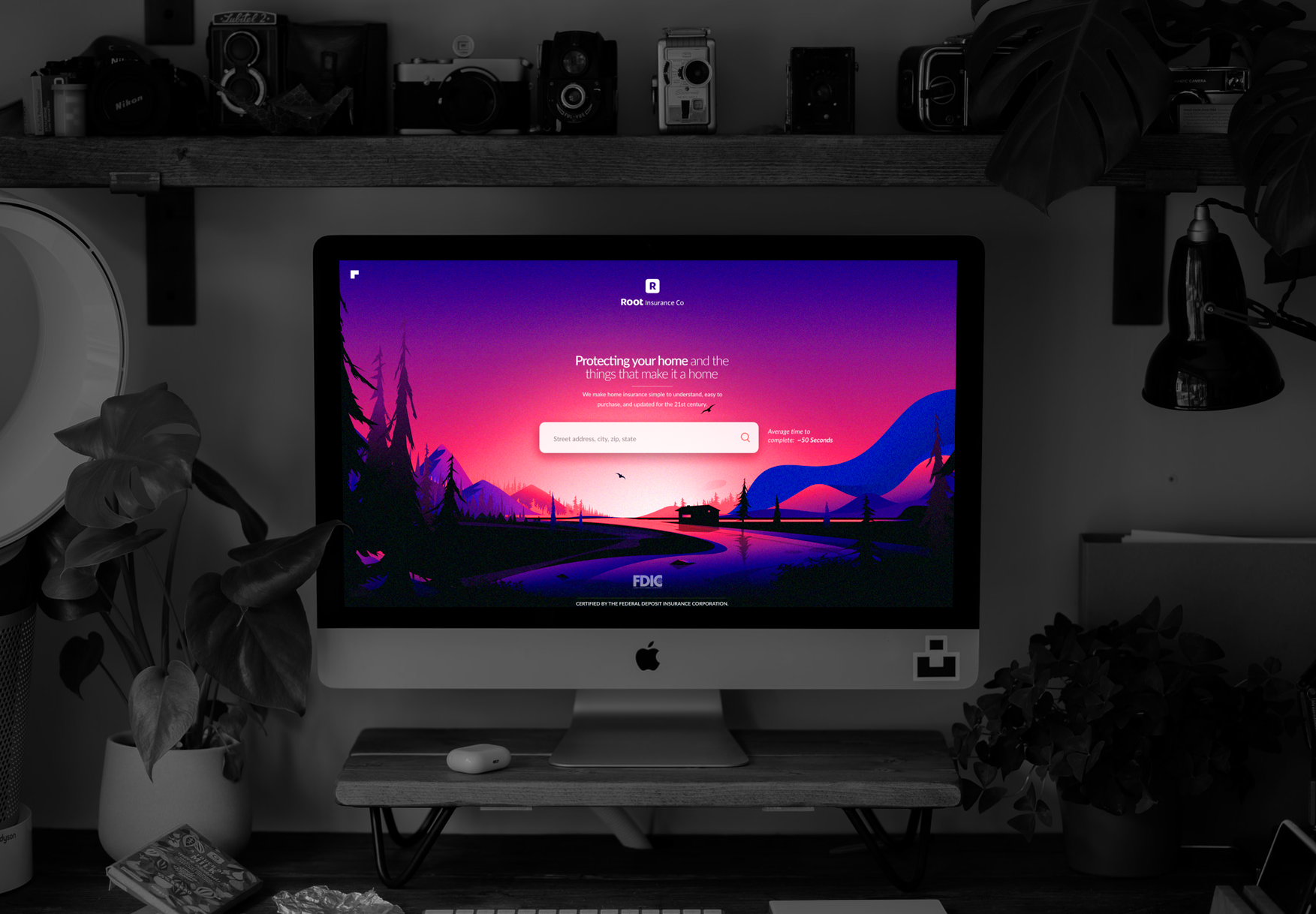

Our iterative development approach was instrumental in refining and optimizing the home insurance journey. Through the use of prototypes and high-fidelity mock-ups, coupled with user interviews and research, we fine-tuned potential product solutions to ensure they aligned seamlessly with user needs and expectations.

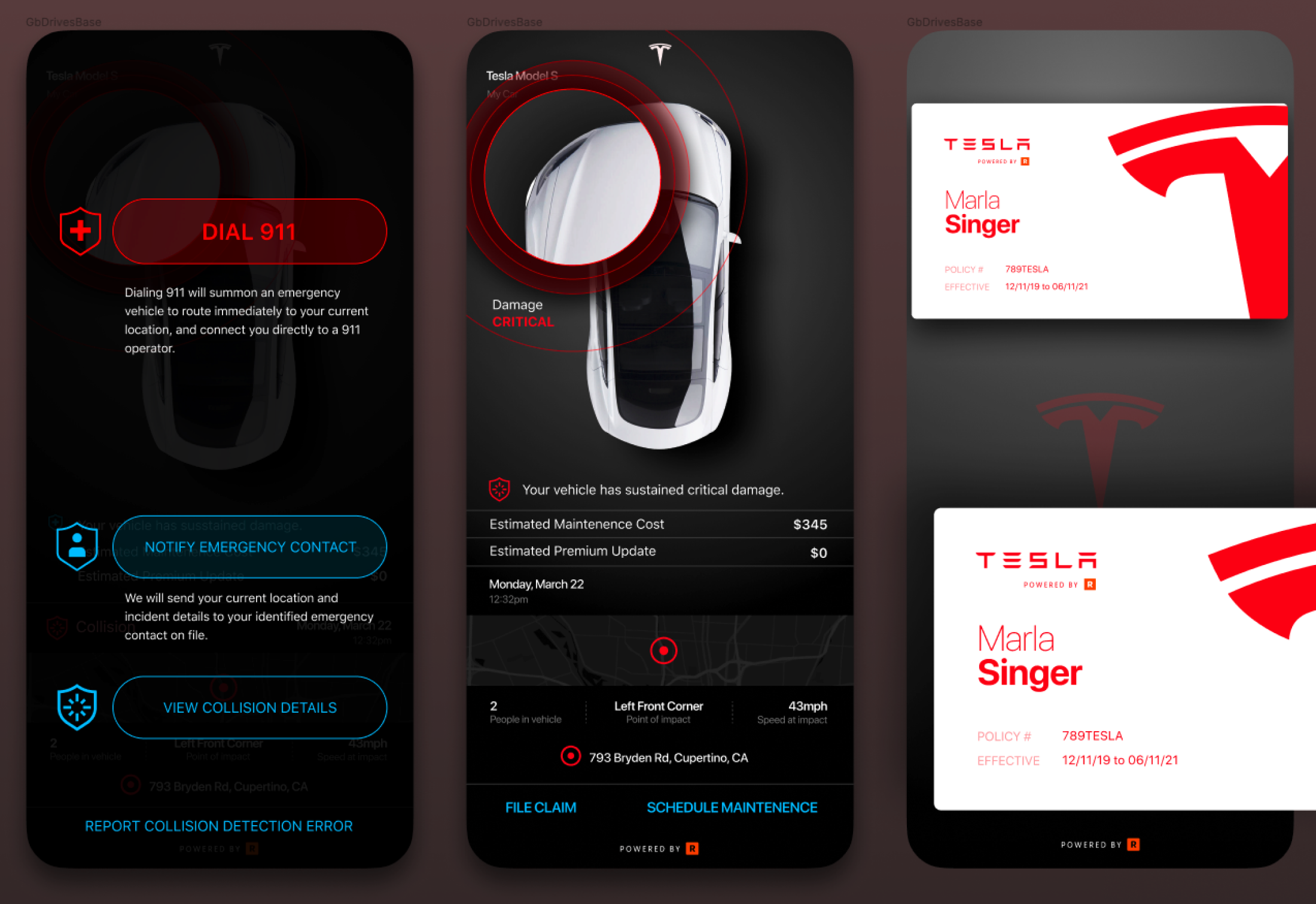

Brand integration played a crucial role in fostering a trustworthy brand image through meticulous user research and studies. The illustration work was meticulously tailored to resonate with the target audience, creating a sense of trust and connection that enhanced the brand's appeal.

User engagement and feedback were key drivers in shaping the final product. Through experimentation and user studies, participants exhibited a keen interest in signing up for the insurance policies we were prototyping, impressed by the warmth and reliability of the brand's messaging.

Lastly, all insights and research findings were meticulously documented to inform and empower product teams, engineering teams, and development teams within the organization. This collaborative approach facilitated effective execution and delivery of the home insurance product, ensuring it met and exceeded user expectations while driving business growth.